Global Shrimp Forum Co-Founder and publisher of shrimp industry blog Shrimp Insights Willem van der Pijl has released a guide to the Indian shrimp industry.

The 196-page informational guide is the product of van der Pijl’s immersion and research on the Indian shrimp industry over the past decade and aims to provide readers with a breakdown on each segment of the shrimp supply chain within the world’s largest shrimp-producing country.

“[The guide] is a one-stop for anyone who wants to get a better understanding of the structure and dynamics of the Indian shrimp industry and the companies that drive it,” van der Pijl told SeafoodSource.

The report outlines the history of shrimp farming in India and its current production landscape and geography. Traditional extensive farming in “trap-and-hold” ponds existed in West Bengal, Kerala, and other states for many years, but commercial shrimp farming did not begin to develop until the late 1980s. Today, while the exact number of farmers is unknown, the report estimates around 100,000 throughout India, with around 100,000 farms in operation.

“[Indian farmers saw a] need to innovate and invest in their supply chains in order to keep a competitive edge in the marketplace. This led to investments in efficient farming operations, investments in value-added fish and shrimp-processing capacity, and a pre-competitive approach toward marketing shrimp in general and Indian-origin shrimp in particular,” van der Pijl told SeafoodSource.

However, according to the report, growth in the country’s shrimp sector has recently stagnated. India’s overall shrimp exports peaked in 2021 at 704,160 metric tons (MT) but reversed course in 2022 and 2023 due to global oversupply and a resulting price drop.

“At the end of 2023, average export prices were just above the level of 2020, when Covid-19 supply chain disruptions caused panic harvests. If we would adjust these prices for inflation, today’s shrimp prices are at their lowest point. The fact that growth has now really stalled illustrates the industry’s challenges,” the report said.

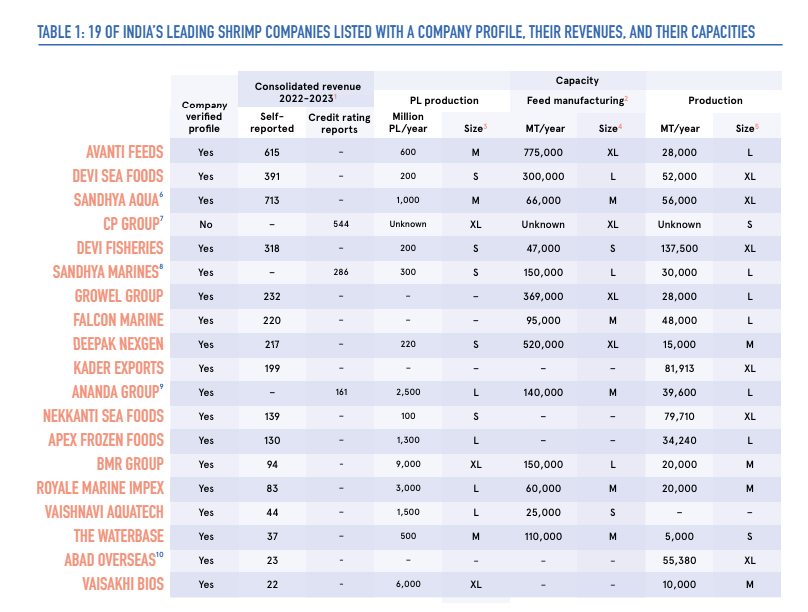

The report also breaks down India’s 19 largest shrimp producers by revenue. Avanti Feeds, which annually manufactures 775,000 MT of feed and produces 28,000 MT of shrimp, was ranked as the largest in the Indian shrimp sector by production and reported revenue of EUR 615 million (USD) for the 2022-23 financial year, according to the report.

Devi Sea Foods was ranked second and reported EUR 391 million (USD) in sales revenue for 2022-23. The company produced 52,000 MT of shrimp during the fiscal year and produced 300,000 MT of feed, marking it as the fifth-largest feed mill in the country.

Despite a recent stalling of export growth, the U.S. remains India’s largest export market and accounts for approximately 40 to 50 percent of total exports. Though India remains the U.S.’s largest shrimp supplier, it is losing market share to Ecuador, especially in the headless, shell-on segment and, to a lesser extent, in the peeled segment. To stimulate growth, many shrimp farmers in the country have begun switching production from vannamei to black tiger shrimp, or monodon shrimp, in an attempt to adapt to rising production costs and other obstacles.

“Although the expansion of monodon production isn’t going as fast as some companies projected, India’s monodon production has already exceeded 50,000 MT in 2023 and will certainly increase over the next couple of years,” the report said. Alongside stagnating production, the Indian shrimp feed market seems to be shrinking, according to the report. Feed demand within the Indian shrimp industry was estimated at around 1.3 million to 1.35 million MT for FY 2022-23 but may contract to around 1.1 million to 1.15 million MT in FY 2023-2024, the report said.

Like farmers, processors are also trying to innovate to find a viable path to growth. More have begun to invest in processing capacity for value-added products, including putting money toward infrastructure and equipment for cooking, dusting, and breading shrimp, as well as for high-quality head-on, shell-on products. Companies are also considering investments in fish processing, likely to diversify their production portfolios, the report found.

“Most of India’s fully dedicated shrimp processors are vertically integrated to some extent. They own hatcheries, feed mills, and shrimp farms. By controlling the value chain, they increase revenues and optimize their margins,” the report said. Most shrimp processors are based in Andhra Pradesh, a region that contains an estimated 95 processing plants, owned by 65 companies, most of which are fully dedicated to shrimp.

The report does not touch on possible human rights violations in the Indian shrimp-processing sector, recently reported by the Corporate Accountability Lab, the Associated Press, and the Outlaw Ocean Project, which van der Pijl said became public after the guide’s researched time frame. The report was created through funding from such sponsors as Apex Frozen Foods, Aquaconnect, Aquaculture Stewardship Council, AquaExchange, Deepak Nexgen, Devi Sea Foods, Devi Fisheries, DSM-Firmenich, Phileo Lesaffre, Sandhya Aqua, Vaisakhi Bios, and Vaishnavi Aquatech. “This report serves as a way for industry insiders within the Indian ecosystem to show their friends, families, and business network to what industry they are a part of,” van der Pijl said. “I hope the document will remain a reference work for the next couple of years.”